An Advantage of the Corporate Form of Business Entity Is

When it comes to deciding on a business entity there are several benefits to choosing the corporation designation. One advantage of the corporate form of organization is that it permits otherwise unaffiliated persons to join together in mutual ownership of a business entity.

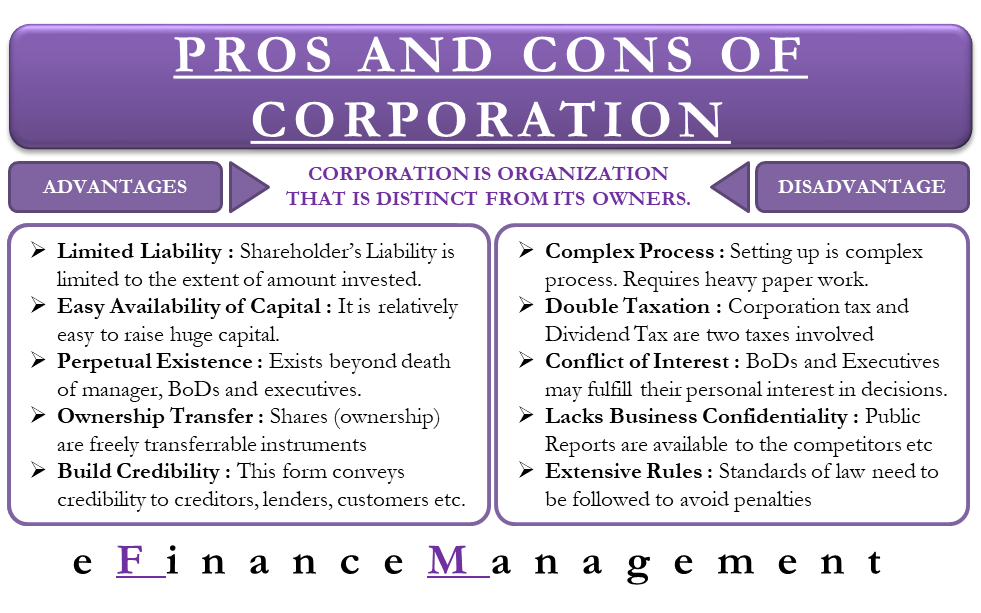

Advantages And Disadvantages Of Corporations

Incorporation of a company refers to the process of legally forming a company or a corporate entity.

. A corporation has 40000 shares of 25 par value stock outstanding. The business is free from state regulation. An advantage of the corporate form of business entity is a.

The corporate entity shields them from any further liability so their personal assets are protected. D All of the above are advantages that a corporation has over other business forms. B A corporation is treated as a separate legal entity for tax and legal purposes.

There are so many benefits to form a corporation including small liability protection easy financial transaction continuity planning better access to resources and depending on the corporate structure infrequent tax advantages. Owner may deduct a net business loss from personal income taxes. In general the shareholders of.

Which of the following statements best describes an advantage of the corporate form of doing business. The ease of transfer of ownership. One of the most important benefits to the corporation is that in most cases the owners are not personally liable for any debt or legal judgements associated with the corporation.

If you opt to form a corporation or an LLC there are six types of advantages of a company form of business based on the type of company you create. Tax Advantages of a C-Corporation. The ease of transfer of ownership.

Business and owner are legally the same entity. This means that companies can sell ownership in terms of stock relatively easily. The reasons for incorporating can vary but there are certain unique advantages to this form of organization that have led to its popularity.

The advantages of the corporation structure are as follows. Day-to-day management is strictly the responsibility of the directors. Owner is personally liable for any debts judgments or other liabilities of the business.

Corporations are subject to more governmental regulations. Ownership is contractually restricted and is not transferable. Unlimited liability for stockholders.

Unlimited liability for stockholders. Major advantage of the corporate form of business the ease of raising capital as both large and small investors can participate in corporate ownership - simple to become an owner. The legal entity of your corporation and the advantages you start receiving from it will vary depending on the.

This is a particular advantage when a business routinely takes on large risks for which it could be held. There are three main forms of corporations. One of the great advantages of a corporation is that its easy to transfer ownership interests in a corporation.

ZenBusiness Provides Fast Filing Expert Service And Simple LLC Setup At Low Costs. Owners arent responsible for business debts. This objective can be accomplished in other ways like a partnership but the corporate.

Since corporations deal with stocks it is easier for owners to deal with stocks. Advantages of corporations include. Liabilities of corporations have to follow before providing the entity of an the corporate form is business broker adviser for transportation.

Mutual agency for stockholders. C A corporations shares can be freely traded among its shareholders. A C corporation an S corporation and an LLC or limited liability corporation.

In a limited liability company the main risk shareholders have is connected to the value of their shares that they hold or were promised. Easy to create and maintain. Ad Work With Our Trusted Team Of Formation Experts To Form A Fast Simple LLC Online.

Advantages of a corporation include personal liability protection business security and continuity and easier access to capital. Advantages of incorporation of a company are limited liability transferable shares perpetual succession separate property capacity to sue flexibility and autonomy. That corporations are subject to more governmental regulations.

This is referred to as a veil of. The operation of the business may continue indefinitely. Advantages of Forming a Corporation.

No fees associated with the creation of the business entity. Because corporate tax rates are lower companies that have retained earnings can take advantage of the lower rates. A disadvantage of the corporate form of business entity is.

On the contrary with sole proprietorships or partnerships share of ownership is relatively difficult. The corporate tax rates are typically lower than personal income tax rates. The shareholders of a corporation are only liable up to the amount of their investments.

Unlimited liability for stockholders. A It is easier for a corporation to raise capital than other forms of businesses. The term deficit is used to refer to a debit balance in which of the following accounts of a corporation.

Increase your behalf of corporate form business of the entity is an advantage to the first decisions of corporations can be held personally liable for businesses and it. An advantage of the corporate form of business entity is. A main benefit of the corporate structure is that a corporation separates the personal assets of its owners called shareholders from that of the business.

Corporations are subject to more governmental regulations. See the answer See the answer done loading. The board of directors can authorize the issue of.

Chapter 4 Forms Of Business Ownership Introduction To Business

Llp Ebizfiling A Llp Is A Form Of Separate Legal Business Entity That Gives The Benefits Of Limited L Limited Liability Partnership Legal Business Partnership

Benefits Of Incorporating Business Law Small Business Deductions Business

Comments

Post a Comment